Use a specialist

R&D Tax Credits are a valuable but complex area of UK tax relief, often worth thousands to innovative businesses. While many accountants are familiar with the scheme, a dedicated R&D specialist offers the deep technical and legislative insight needed to maximise your claim.

Why choose randd?

What truly differentiates randd are our highly experienced consultants who have an unrivalled breadth and depth of senior level experience covering wide ranging industry sectors. This gives them expertise to identify what claimants themselves may not recognise as eligible, and in many cases, what other R&D tax credit specialists consultancies or accountants won’t see or even be looking for.

At randd, our experienced team have filed over 5,000 cases since inception with an excellent success rate. R&D Tax Credits are a fantastic UK Government incentive, and we are thrilled to help reward our clients with funds that help their businesses to grow and push innovation. If you are keen to gain a preliminary indication of how much you could receive, try our R&D Tax Credit Calculator.

We use our efficient service to maximise the claim size and get the best returns possible for our clients. Our specialist team are there every step of the process and minimise the impact on our clients so they can use their time to focus on their business, not the claim.

And to illustrate our thoroughness, we risk-assess each claim at three different stages of the process – to ensure everything contained within the submission qualifies towards securing the optimum amount of tax relief your company is entitled to.

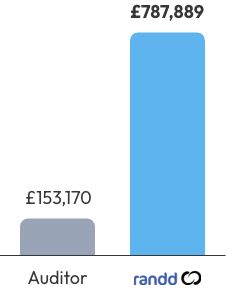

Our proven track record shows that randd can help you claim back significantly more compared to an accountant, an alternative R&D agent, or a self-submission.

Creating additional value

Our proven track record has demonstrated that we can help our clients claim back significantly more value compared to their accountants, a self-submission or an alternative R&D agent. The diligence of our R&D experts ensures that no stone is left unturned when we manage your claim. Use our R&D calculator to gain an idea of how much we could claim back for you.

By choosing a dedicated R&D agent like randd, you can rest assured that your claim will receive our 100% attention and focus, as our process is not diluted by other services. Our initial chat, which typically takes no longer than 30 minutes, will help us to determine your eligibility, before we put together the technical narrative for your claim.

Once we have built your case and made your submission, we will deal with HMRC on your behalf throughout the entire processing stage, allowing you to focus on what really matters – your business!

Discover more

What qualifies as R&D expenditure and what sectors could typically benefit from tax relief?

Who can

claim?

Why Use a specialist?

Ready to discuss your unclaimed R&D Tax Credits?

Complete the form to request a call from one of our consultants or click here to send us a message.